Title: LC prepayments rising

Post by: Fred93 on November 14, 2016, 11:00:00 PM

Post by: Fred93 on November 14, 2016, 11:00:00 PM

In the past I haven't thought about prepayments much. They happen. We put up with them. In recent months tho, something is changing. Prepayments are increasing. (For the record, worrying about this was Rob L's idea.)

The chart below shows prepayments in the first few months of a loan. Each curve shows how prepayment by certain "age" of the loans varies with vintage. The curves are cumulative. The red "month 1" curve shows the fraction of loans that have prepaid by the end of month 1, so it includes the month 0 prepays. The horizontal axis shows the quarter in which the loan was issued, more or less (1).

Look at the right side of the chart. You can see that in the past nobody ever prepaid during the first month (month 0), but recently 1.5% of borrowers are doing just that. Furthermore, that rate is still climbing. Interestingly, the increase is all in month 0, which is the month that in the past never had any prepays.

I wonder what is going on here. Why do people prepay before the first payment is due? And whatever the reason is, why is it happening now and not in prior years? I have a theory.

My idea is that this is a sign of competition among online lenders. There are now a lot of different online lenders. Suppose you pick one and borrow, but during your investigation you discover all these other guys, and you check the interest rate they offer. Seems likely that quite often you would find another guy who offers you a lower rate. At that point a logical person might borrow from the 2nd guy and pay off the 1st guy.

If I'm right, then the proliferation of online lending is generating competition whose impact we can see. I'm thinking that this is an explicit example of pressure on LC to keep rates low. We lenders tend to ascribe the "bad" rate reductions during the past 2 years to LC & Prosper's lust for growth. Growing competition was likely part of the picture.

There have been a few articles recently about "stacking" by online borrowers. The credit bureaus have noticed more folks borrowing from more than one online lender in rapid succession. The thrust of these articles is always that this is a sign of fraud. Maybe it is. However, credit bureaus, who want to sell new services, seed such articles with the intent to frighten their customers, so we should stay skeptical. Some of these stackers are apparently just repaying their loans with cheaper ones.

(1) footnote: I've recently learned that when LC provides data by "vintage", that they assign the vintages by the date of the first payment, not the date of origination. I learned this only by processing the payment history file. In fact, this probably occurs because some fellow at LC is generating the prepayment data from the payment history file. The payment history file only contains information about payments, not origination. Because LC allows borrowers to set the payment day, and then censors the payment day from the payment history file, there is no way to reconstruct the issue date. All of which is to say that while we think of the vintage quarters (like "15Q4") as being the quarter of loan origination, actually there can be up to 1 month of slop. This may only matter to data nerds who expect consistency between data from multiple files provided by the same company, but don't find it. For example, if you add up the number of loans in a given quarter from the loan history files, they don't match the number of loans in a quarter from the payment history file, because of this slop. Personally, I prefer consistency. Its something you can test for to help ensure that your software isn't fouling up. Of course when the guy upstream from you is completely undisciplined and issues massive data files that are inconsistent by design, then this doesn't work.

The chart below shows prepayments in the first few months of a loan. Each curve shows how prepayment by certain "age" of the loans varies with vintage. The curves are cumulative. The red "month 1" curve shows the fraction of loans that have prepaid by the end of month 1, so it includes the month 0 prepays. The horizontal axis shows the quarter in which the loan was issued, more or less (1).

Look at the right side of the chart. You can see that in the past nobody ever prepaid during the first month (month 0), but recently 1.5% of borrowers are doing just that. Furthermore, that rate is still climbing. Interestingly, the increase is all in month 0, which is the month that in the past never had any prepays.

I wonder what is going on here. Why do people prepay before the first payment is due? And whatever the reason is, why is it happening now and not in prior years? I have a theory.

My idea is that this is a sign of competition among online lenders. There are now a lot of different online lenders. Suppose you pick one and borrow, but during your investigation you discover all these other guys, and you check the interest rate they offer. Seems likely that quite often you would find another guy who offers you a lower rate. At that point a logical person might borrow from the 2nd guy and pay off the 1st guy.

If I'm right, then the proliferation of online lending is generating competition whose impact we can see. I'm thinking that this is an explicit example of pressure on LC to keep rates low. We lenders tend to ascribe the "bad" rate reductions during the past 2 years to LC & Prosper's lust for growth. Growing competition was likely part of the picture.

There have been a few articles recently about "stacking" by online borrowers. The credit bureaus have noticed more folks borrowing from more than one online lender in rapid succession. The thrust of these articles is always that this is a sign of fraud. Maybe it is. However, credit bureaus, who want to sell new services, seed such articles with the intent to frighten their customers, so we should stay skeptical. Some of these stackers are apparently just repaying their loans with cheaper ones.

(1) footnote: I've recently learned that when LC provides data by "vintage", that they assign the vintages by the date of the first payment, not the date of origination. I learned this only by processing the payment history file. In fact, this probably occurs because some fellow at LC is generating the prepayment data from the payment history file. The payment history file only contains information about payments, not origination. Because LC allows borrowers to set the payment day, and then censors the payment day from the payment history file, there is no way to reconstruct the issue date. All of which is to say that while we think of the vintage quarters (like "15Q4") as being the quarter of loan origination, actually there can be up to 1 month of slop. This may only matter to data nerds who expect consistency between data from multiple files provided by the same company, but don't find it. For example, if you add up the number of loans in a given quarter from the loan history files, they don't match the number of loans in a quarter from the payment history file, because of this slop. Personally, I prefer consistency. Its something you can test for to help ensure that your software isn't fouling up. Of course when the guy upstream from you is completely undisciplined and issues massive data files that are inconsistent by design, then this doesn't work.

Title: LC prepayments rising

Post by: RT45 on November 14, 2016, 11:00:00 PM

Post by: RT45 on November 14, 2016, 11:00:00 PM

Two other things I've seen:

1) Person applies for a loan, they realize they can optimize their rate by obtaining a loan with a different purpose, lower amount etc. and applies for a more optimized loan.

2) Spouse 1 applies for a loan, realizes there are more efficient ways to borrow be it credit score, or the reasons listed above and applies for a loan under Spouse 2.

LendingClub is definitely cannibalizing their own business by trying to refinance borrowers very early on causing many widespread pre-payments, but that is a separate issue and likely wouldn't be related to a prepayment on the 1st payment.

1) Person applies for a loan, they realize they can optimize their rate by obtaining a loan with a different purpose, lower amount etc. and applies for a more optimized loan.

2) Spouse 1 applies for a loan, realizes there are more efficient ways to borrow be it credit score, or the reasons listed above and applies for a loan under Spouse 2.

LendingClub is definitely cannibalizing their own business by trying to refinance borrowers very early on causing many widespread pre-payments, but that is a separate issue and likely wouldn't be related to a prepayment on the 1st payment.

Title: LC prepayments rising

Post by: Rob L on November 14, 2016, 11:00:00 PM

Post by: Rob L on November 14, 2016, 11:00:00 PM

Yeah, I posted this about a month ago and it seemed not to generate any interest. Now I see you were interested!

I was only addressing MOB 0 (your blue line). You covered the first 4 (MOB 0 through MOB 3).

As for the reason for the change your theories may be correct or maybe not.

<edit>

Doesn't the borrower have to give LC a significant amount of money up front in origination fees (withheld from $ placed into their account)?

How can they just give that money away and come out ahead with another lender?

That implies the second loan they get is enough to pay off entire principal, not just the amount they received from LC.

Then the APR from the second lender must be low enough to pay all that and the borrower wind up with a lower monthly payment.

Nah; I wouldn't be surprised there's some scam here and it's growing. Just not devious enough to figure it out yet.

<end edit>

REGARDLESS THIS IS A MAJOR BEHAVIORAL CHANGE!!

Quote"> from: Rob L on October 18, 2016, 05:42:36 PM

I was only addressing MOB 0 (your blue line). You covered the first 4 (MOB 0 through MOB 3).

As for the reason for the change your theories may be correct or maybe not.

<edit>

Doesn't the borrower have to give LC a significant amount of money up front in origination fees (withheld from $ placed into their account)?

How can they just give that money away and come out ahead with another lender?

That implies the second loan they get is enough to pay off entire principal, not just the amount they received from LC.

Then the APR from the second lender must be low enough to pay all that and the borrower wind up with a lower monthly payment.

Nah; I wouldn't be surprised there's some scam here and it's growing. Just not devious enough to figure it out yet.

<end edit>

REGARDLESS THIS IS A MAJOR BEHAVIORAL CHANGE!!

Quote"> from: Rob L on October 18, 2016, 05:42:36 PM

Title: LC prepayments rising

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

LOL  (and you did tell me where to look for the data I posted).

(and you did tell me where to look for the data I posted).

PS: I added some stuff to the initial reply.

(and you did tell me where to look for the data I posted).

(and you did tell me where to look for the data I posted).PS: I added some stuff to the initial reply.

Title: LC prepayments rising

Post by: yojoakak on November 14, 2016, 11:00:00 PM

Post by: yojoakak on November 14, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Post by: TravelingPennies on November 14, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: rawraw on November 15, 2016, 11:00:00 PM

Post by: rawraw on November 15, 2016, 11:00:00 PM

Isn't the simplest explanation that LC is being more aggressive in cannibalizing loans to restore volume?

Title: LC prepayments rising

Post by: TravelingPennies on November 15, 2016, 11:00:00 PM

Post by: TravelingPennies on November 15, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on November 15, 2016, 11:00:00 PM

Post by: TravelingPennies on November 15, 2016, 11:00:00 PM

Whenever Core discovered that LC was sending mailings to existing customers, it wasn't from this site but some review site.

LC doesn't disclose (to my knowledge) their underwriting like they used to. But they could be changing the rate based on something else besides FICO. Competition just doesn't strike me as a good explanation for month 0, but I could be off. Just speculation on my end

Sent from my SAMSUNG-SM-G935A using Tapatalk

LC doesn't disclose (to my knowledge) their underwriting like they used to. But they could be changing the rate based on something else besides FICO. Competition just doesn't strike me as a good explanation for month 0, but I could be off. Just speculation on my end

Sent from my SAMSUNG-SM-G935A using Tapatalk

Title: LC prepayments rising

Post by: Zach on November 15, 2016, 11:00:00 PM

Post by: Zach on November 15, 2016, 11:00:00 PM

While the rate would have to be somewhat lower, several balance sheet lenders (banks and others), like Discover, offer competitive loan products that don't charge an origination fee.

That makes the switching cost less if there is a slight rate improvement.

That makes the switching cost less if there is a slight rate improvement.

Title: LC prepayments rising

Post by: anabio on November 15, 2016, 11:00:00 PM

Post by: anabio on November 15, 2016, 11:00:00 PM

I'm not sure if it could explain why there is a recent spike in prepayments but one reason why a loan is prepaid real early might be that the borrower became "super conscious" of the monthly payment.

What does the auto salesman talk about concerning the cost of buying a car? The monthly payment of course. "What if I can get that monthly payment down to ". People don't seem to care about the loan amount as much as the monthly payment.

". People don't seem to care about the loan amount as much as the monthly payment.

What if borrowers realized they could lower their monthly payment dramatically by going for a 5 year loan instead of a 3 year loan?

Someone showed a chart of 3 year loan prepayments...what does the chart of 5 year prepayments look like?

Of course...this still would not explain month 0 prepayments. I doubt the borrower would be able to get that 5 or more year loan that soon after closing on their LC loan.

What does the auto salesman talk about concerning the cost of buying a car? The monthly payment of course. "What if I can get that monthly payment down to

". People don't seem to care about the loan amount as much as the monthly payment.

". People don't seem to care about the loan amount as much as the monthly payment.What if borrowers realized they could lower their monthly payment dramatically by going for a 5 year loan instead of a 3 year loan?

Someone showed a chart of 3 year loan prepayments...what does the chart of 5 year prepayments look like?

Of course...this still would not explain month 0 prepayments. I doubt the borrower would be able to get that 5 or more year loan that soon after closing on their LC loan.

Title: LC prepayments rising

Post by: TravelingPennies on November 15, 2016, 11:00:00 PM

Post by: TravelingPennies on November 15, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: Fred93 on November 15, 2016, 11:00:00 PM

Post by: Fred93 on November 15, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on November 15, 2016, 11:00:00 PM

Post by: TravelingPennies on November 15, 2016, 11:00:00 PM

Got a partial answer from LC. They sayQuote

Title: LC prepayments rising

Post by: rawraw on November 15, 2016, 11:00:00 PM

Post by: rawraw on November 15, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: Fred on November 16, 2016, 11:00:00 PM

Post by: Fred on November 16, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: Peter on November 16, 2016, 11:00:00 PM

Post by: Peter on November 16, 2016, 11:00:00 PM

I could swear we discussed this - and that I wrote about this phenom extensively - last month... DFS/STI/GS all now "actively poaching"...

Title: LC prepayments rising

Post by: SLCPaladin on November 16, 2016, 11:00:00 PM

Post by: SLCPaladin on November 16, 2016, 11:00:00 PM

I wonder if something else might be going on as well, like some people who go out looking for a 3 or 5 year loan are really just looking for a bridge loan. They may have assets that are tied up or just have some cash flow issues and need extremely short-term financing. Even though a 5% origination fee is steep, maybe it's the only option, or maybe other options are simply more painful from a financial standpoint.

I also agree with Anabio about the monthly payment vs. interest rate. In my experience, people are much more concerned about the amount they pay each month as opposed to the total amount they pay or the interest rate.

So maybe a quick refinance with a competitor that results in a lower monthly payment, even if it is more costly overall, might tip the scales in favor of a month 0 repayment and refi with an LC competitor.

I also agree with Anabio about the monthly payment vs. interest rate. In my experience, people are much more concerned about the amount they pay each month as opposed to the total amount they pay or the interest rate.

So maybe a quick refinance with a competitor that results in a lower monthly payment, even if it is more costly overall, might tip the scales in favor of a month 0 repayment and refi with an LC competitor.

Title: LC prepayments rising

Post by: RT45 on November 17, 2016, 11:00:00 PM

Post by: RT45 on November 17, 2016, 11:00:00 PM

Good read on prepayments and fraud from WSJ.

http://www.wsj.com/articles/borrower-or-fraudster-online-lenders-scramble-to-tell-the-difference-1477580637

Pro Tip: If you don't have a paid subscription, Google the headline and click through from Google and it will unlock the paywall.

http://www.wsj.com/articles/borrower-or-fraudster-online-lenders-scramble-to-tell-the-difference-1477580637

Pro Tip: If you don't have a paid subscription, Google the headline and click through from Google and it will unlock the paywall.

Title: LC prepayments rising

Post by: TravelingPennies on November 19, 2016, 11:00:00 PM

Post by: TravelingPennies on November 19, 2016, 11:00:00 PM

I think the WSJ article is a bad article. It is just an echo of some recent Transunion propaganda piece intended to push a new Transunion service.

It talks about stacking, and gives some statistics on how stacking has increased, but note that the article fails to make a connection between stacking and loan quality, fails to make a connection between stacking and delinquency, fails to make a connection between stacking and fraud. Fails to make a connection between stacking and anything actually.

Lots of insinuation, but no data.

The only "news" in the article is that TU is pitching some new service.

It talks about stacking, and gives some statistics on how stacking has increased, but note that the article fails to make a connection between stacking and loan quality, fails to make a connection between stacking and delinquency, fails to make a connection between stacking and fraud. Fails to make a connection between stacking and anything actually.

Lots of insinuation, but no data.

The only "news" in the article is that TU is pitching some new service.

Title: LC prepayments rising

Post by: TravelingPennies on November 30, 2016, 11:00:00 PM

Post by: TravelingPennies on November 30, 2016, 11:00:00 PM

Update. LC has published the November prepayments file, so I updated my chart. This gives us the first prepayment numbers for vintage 2016Q3. Bottom line is that month 0 prepayments continue to increase.

Notes:

1. After I gave a copy of the prior version of this chart to LC, and asked for an explanation of the increase in month 0 prepayments, I got two responses. The first was that prior to 2014, their software was not set up to record payoffs in month 0. This historical quirk explains the long string of zeros in the old month 0 data. Their second comment was that the events of May 2016 caused a slowdown in lender activity, so in the days following that event, there were loans where the borrower was approved, but not funded quickly. As a result, a significant number of borrowers found money elsewhere, then cancelled the LC loan, and that these were recorded as payoffs in month 0. The timing of these events was not made explicit. For example, I don't know if the borrower actually got the money and told LC to take it back, or if the loan was cancelled before the money transferred to the borrower. I didn't inquire further. I noted that could explain some of the jump in 2016Q2, but not Q1 or Q3, nor the obvious trend. I don't believe the right people at LC took this inquiry seriously. The overall question of why this is happening remains unanswered.

2. After my conversation with LC I realized that there were hints there that I (we?) don't understand the precise definition of a prepayment in month 0. Perhaps that can be discussed further at some later time.

3. Careful observers may note that these curves don't look exactly like the curves I plotted from the Oct 2016 prepayment file. Every data point has moved slightly. This indicates a bug in LC's software. There is no other explanation. The prepayments during month 1 of loans issued in 2014, 2013, etc (for example) are a historical fact, and cannot change during 2016, so those old numbers should be constant from one prepayments file to the next, and yet, they have changed between the Oct2016 and Nov2016 prepayments files. You can see, for example, that 2014Q4 now shows a dip which is not present in last month's chart. I presume this bug is due to some quirk in the data which is not properly handled by LC's software. I'm just making a visual representation of the data LC has published. The changes induced by this bug appear to be small from month to month, so its not a big deal unless perhaps it is a clue to some larger problem.

Notes:

1. After I gave a copy of the prior version of this chart to LC, and asked for an explanation of the increase in month 0 prepayments, I got two responses. The first was that prior to 2014, their software was not set up to record payoffs in month 0. This historical quirk explains the long string of zeros in the old month 0 data. Their second comment was that the events of May 2016 caused a slowdown in lender activity, so in the days following that event, there were loans where the borrower was approved, but not funded quickly. As a result, a significant number of borrowers found money elsewhere, then cancelled the LC loan, and that these were recorded as payoffs in month 0. The timing of these events was not made explicit. For example, I don't know if the borrower actually got the money and told LC to take it back, or if the loan was cancelled before the money transferred to the borrower. I didn't inquire further. I noted that could explain some of the jump in 2016Q2, but not Q1 or Q3, nor the obvious trend. I don't believe the right people at LC took this inquiry seriously. The overall question of why this is happening remains unanswered.

2. After my conversation with LC I realized that there were hints there that I (we?) don't understand the precise definition of a prepayment in month 0. Perhaps that can be discussed further at some later time.

3. Careful observers may note that these curves don't look exactly like the curves I plotted from the Oct 2016 prepayment file. Every data point has moved slightly. This indicates a bug in LC's software. There is no other explanation. The prepayments during month 1 of loans issued in 2014, 2013, etc (for example) are a historical fact, and cannot change during 2016, so those old numbers should be constant from one prepayments file to the next, and yet, they have changed between the Oct2016 and Nov2016 prepayments files. You can see, for example, that 2014Q4 now shows a dip which is not present in last month's chart. I presume this bug is due to some quirk in the data which is not properly handled by LC's software. I'm just making a visual representation of the data LC has published. The changes induced by this bug appear to be small from month to month, so its not a big deal unless perhaps it is a clue to some larger problem.

Title: LC prepayments rising

Post by: TravelingPennies on November 30, 2016, 11:00:00 PM

Post by: TravelingPennies on November 30, 2016, 11:00:00 PM

Fred93 is the only person I've ever seen footnoting forum posts. Hilarious and strangely effective at keeping TLDR reaction at bay

Title: LC prepayments rising

Post by: yielder on November 30, 2016, 11:00:00 PM

Post by: yielder on November 30, 2016, 11:00:00 PM

Hello Everyone -

Could month 0 prepayments be on the rise due to LC's securitization process? The lender just buys your loan & moves it to their own portfolio?

Big lenders have a lot of clout & with the retail investors gone poof, LC needs lenders.

So they get special favors. Like maybe taking out your loans.

That would not be great news for investors, right? Because the loans that are higher quality are taken out meanwhile we keep the lower quality ones.

Hmm... What do you all think?

Could month 0 prepayments be on the rise due to LC's securitization process? The lender just buys your loan & moves it to their own portfolio?

Big lenders have a lot of clout & with the retail investors gone poof, LC needs lenders.

So they get special favors. Like maybe taking out your loans.

That would not be great news for investors, right? Because the loans that are higher quality are taken out meanwhile we keep the lower quality ones.

Hmm... What do you all think?

Title: LC prepayments rising

Post by: Rob L on November 30, 2016, 11:00:00 PM

Post by: Rob L on November 30, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on November 30, 2016, 11:00:00 PM

Post by: TravelingPennies on November 30, 2016, 11:00:00 PM

Title: LC prepayments rising

Post by: we2ding on December 02, 2016, 11:00:00 PM

Post by: we2ding on December 02, 2016, 11:00:00 PM

I have had 3/108 repaid fully and I just joined in Oct.

Title: LC prepayments rising

Post by: sean3.eth on December 02, 2016, 11:00:00 PM

Post by: sean3.eth on December 02, 2016, 11:00:00 PM

I've had 928 notes pay off early and my account isn't even old enough to have had my first 3-year note reach maturity.

Title: LC prepayments rising

Post by: sean3.eth on February 18, 2017, 11:00:00 PM

Post by: sean3.eth on February 18, 2017, 11:00:00 PM

Are borrowers using a second loan from Lending Club to pay off their first Lending Club loan? The answer is yes

Title: LC prepayments rising

Post by: TravelingPennies on February 18, 2017, 11:00:00 PM

Post by: TravelingPennies on February 18, 2017, 11:00:00 PM

These are just a sample of the reviews posted on Lending Club's own website.

Lending Club gives second loan to borrower. Borrower uses it to pay off their first loan. Lending Club charges 1% penalty to retail investors on outstanding principal for early prepayment even though the source of the prepayment funds came from Lending Club.

Lending Club gets another origination fee on the 2nd loan. If they dangle lower interest rates or a lower monthly payment, well then some borrowers are inevitably going to use the second loan to pay off the first one.

Question is, why should retail investors get hit with a penalty for this? At best retail investors become collateral damage.... at worst... well...

Lending Club gives second loan to borrower. Borrower uses it to pay off their first loan. Lending Club charges 1% penalty to retail investors on outstanding principal for early prepayment even though the source of the prepayment funds came from Lending Club.

Lending Club gets another origination fee on the 2nd loan. If they dangle lower interest rates or a lower monthly payment, well then some borrowers are inevitably going to use the second loan to pay off the first one.

Question is, why should retail investors get hit with a penalty for this? At best retail investors become collateral damage.... at worst... well...

Title: LC prepayments rising

Post by: Rob L on February 18, 2017, 11:00:00 PM

Post by: Rob L on February 18, 2017, 11:00:00 PM

Smoking gun.

Title: LC prepayments rising

Post by: TravelingPennies on February 18, 2017, 11:00:00 PM

Post by: TravelingPennies on February 18, 2017, 11:00:00 PM

Does Lending Club know that some borrowers are using their second loan to pay off their first? The answer is Yes

How can they not tell the retail investor this but still charge them a fee for an "early prepayment" that they were the cause of?

How can they not tell the retail investor this but still charge them a fee for an "early prepayment" that they were the cause of?

Title: LC prepayments rising

Post by: TravelingPennies on February 18, 2017, 11:00:00 PM

Post by: TravelingPennies on February 18, 2017, 11:00:00 PM

I mean these reviews are right on Lending Club's website...

I've attached 16 already that are pretty clear...

I've attached 16 already that are pretty clear...

Title: LC prepayments rising

Post by: Fred93 on February 18, 2017, 11:00:00 PM

Post by: Fred93 on February 18, 2017, 11:00:00 PM

On the other hand...

In a period of falling interest rates, one has to expect refinancing.

If LC doesn't do it, then somebody else will, eh?

I do get your basic point, which I believe is that LC's motivations and ours are not well aligned on this issue.

In a period of falling interest rates, one has to expect refinancing.

If LC doesn't do it, then somebody else will, eh?

I do get your basic point, which I believe is that LC's motivations and ours are not well aligned on this issue.

Title: LC prepayments rising

Post by: TravelingPennies on February 19, 2017, 11:00:00 PM

Post by: TravelingPennies on February 19, 2017, 11:00:00 PM

About a month ago I began investing in B grade only loans and created a new portfolio for them. Since that time I've purchased 259 notes. They break down as follows:

In Funding 1

In Review 5

Issuing 15

Issued 231

Current 5

Fully Paid 2

So, no payments have yet come due for any of the first 4 categories (252) of the 259 loans yet I've already had two paid off early and in full.

One was issued on 1/31/2017 and fully paid only 8 days later on 2/7/2016 (loan id 97202338).

The other was issued on 1/26/2017 and fully paid only 26 days later on 2/17 (loan id 96737405).

Makes no sense!

In Funding 1

In Review 5

Issuing 15

Issued 231

Current 5

Fully Paid 2

So, no payments have yet come due for any of the first 4 categories (252) of the 259 loans yet I've already had two paid off early and in full.

One was issued on 1/31/2017 and fully paid only 8 days later on 2/7/2016 (loan id 97202338).

The other was issued on 1/26/2017 and fully paid only 26 days later on 2/17 (loan id 96737405).

Makes no sense!

Title: LC prepayments rising

Post by: newstreet on February 19, 2017, 11:00:00 PM

Post by: newstreet on February 19, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on February 19, 2017, 11:00:00 PM

Post by: TravelingPennies on February 19, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: apc3161 on February 19, 2017, 11:00:00 PM

Post by: apc3161 on February 19, 2017, 11:00:00 PM

I just asked LC in an email if they could tell me what percentage of pre-payed loans are due to LC's own refinancing. They couldn't/wouldn't provide this info:

"All the information we display public ally is located on our Statistics page and we currently do not have the data for how many of the pre paid loans are from refinancing. Thank you for your understanding."

"All the information we display public ally is located on our Statistics page and we currently do not have the data for how many of the pre paid loans are from refinancing. Thank you for your understanding."

Title: LC prepayments rising

Post by: TravelingPennies on February 19, 2017, 11:00:00 PM

Post by: TravelingPennies on February 19, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: jheizer on February 20, 2017, 11:00:00 PM

Post by: jheizer on February 20, 2017, 11:00:00 PM

I've been poking around with this tonight and I wouldn't be surprised now if LC said that at least 5% of the loans are a second loan and/or refi. The number of what I am assuming are matches is huge. It could be way more as I've just roughly matching data that is exactly the same. So if they got for example a $1k raise I'd miss them. There are even a decent number of people I'd assume have had 3 loans, but only 2 active at a time on the few I looked at in more detail.

Spot checking a few, it seems a lost of them are falling behind and need a second, riskier, larger loan. Some times they paid off the first one, some times they both went to charged off. I didn't seem to come across too many where it seemed like they refied to a lower rate. But I only looked at the details of 2 dozen or so cases so it could just be the luck of the draw. I'd have to write some code to get a better idea.

Example of someone who has had 3 loans and slowly going down hill. 31216399 65007223 91594336 Vacations are important...

Spot checking a few, it seems a lost of them are falling behind and need a second, riskier, larger loan. Some times they paid off the first one, some times they both went to charged off. I didn't seem to come across too many where it seemed like they refied to a lower rate. But I only looked at the details of 2 dozen or so cases so it could just be the luck of the draw. I'd have to write some code to get a better idea.

Example of someone who has had 3 loans and slowly going down hill. 31216399 65007223 91594336 Vacations are important...

Title: LC prepayments rising

Post by: TravelingPennies on February 22, 2017, 11:00:00 PM

Post by: TravelingPennies on February 22, 2017, 11:00:00 PM

I decided to look at this again tonight.

1,321,818 - Number of Loans in the historical files

8,341 - People I believe have taken out 2 or more loans. I tightened up my matching from the above post as I think 5% was just too many.

The following are the number of people that have taken out at least 2 loans and the first one is in "Fully Paid" status and the second one:

1,512 - ... is ONE letter grade better or more.

1,286 - ... is ONE letter grade better or more and the second loan was started within 550 days of the first loan.

466 - ... is TWO letter grade better or more and the second loan was started within 550 days of the first loan.

And the ones that are probably the worst for us:

512- ... is ONE letter grade better or more and the second loan was started after 350 days and before 550 days of the first loan.

Things to note:

Grade difference in this case is defined as a change in a whole grade only looking at the letter and not the sub grade number.

I did not check the ending date of the first loan vs the starting date of the second one to check over overlaps.

This is all assuming the first 8,341 people I identified was correct. I'm not sure if that is a reasonable number or not.

So my guess would be they are not offering up as many refinances as we first thought. Or I am being too strict on matching people.

A bit of side information. The status of the 16k loans that make up the duplicates:

Code: [Select]

1,321,818 - Number of Loans in the historical files

8,341 - People I believe have taken out 2 or more loans. I tightened up my matching from the above post as I think 5% was just too many.

The following are the number of people that have taken out at least 2 loans and the first one is in "Fully Paid" status and the second one:

1,512 - ... is ONE letter grade better or more.

1,286 - ... is ONE letter grade better or more and the second loan was started within 550 days of the first loan.

466 - ... is TWO letter grade better or more and the second loan was started within 550 days of the first loan.

And the ones that are probably the worst for us:

512- ... is ONE letter grade better or more and the second loan was started after 350 days and before 550 days of the first loan.

Things to note:

Grade difference in this case is defined as a change in a whole grade only looking at the letter and not the sub grade number.

I did not check the ending date of the first loan vs the starting date of the second one to check over overlaps.

This is all assuming the first 8,341 people I identified was correct. I'm not sure if that is a reasonable number or not.

So my guess would be they are not offering up as many refinances as we first thought. Or I am being too strict on matching people.

A bit of side information. The status of the 16k loans that make up the duplicates:

Code: [Select]

Title: LC prepayments rising

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: jheizer on February 23, 2017, 11:00:00 PM

Post by: jheizer on February 23, 2017, 11:00:00 PM

Yup, pretty small odds, like you said if things were done right. Last night I tightened up the person matching from I'm pretty sure they are the same to they absolutely have to be. For it to be in error now you'd basically have to be working the same fixed rate (factory like job) in the same place with the same title and have the same starting credit date. I decided I'd rather guess up from here than have a starting possibly inflated number. So even if I am off by a factor of 10, that is still only 1% for your picked case.

The reason I included the grade jump was I assumed with the initial fees you'd have to get some kind of decent interest rate boost to make it worth it for a general refi scenario vs just taking out a bigger loan because you need more money now. But that is assuming people understand the numbers...

550 was a random guess. Close enough to crossing the 1 year mark that it would be annoying, but far enough out that after that we probably can't blame a LC marketing campaign.

I'll run any scenarios anyone wants. It only takes me a few seconds to adjust the code and a few minutes for it to run. I'm sitting here in front of a computer all day anyway. Just let me know specifics.

The reason I included the grade jump was I assumed with the initial fees you'd have to get some kind of decent interest rate boost to make it worth it for a general refi scenario vs just taking out a bigger loan because you need more money now. But that is assuming people understand the numbers...

550 was a random guess. Close enough to crossing the 1 year mark that it would be annoying, but far enough out that after that we probably can't blame a LC marketing campaign.

I'll run any scenarios anyone wants. It only takes me a few seconds to adjust the code and a few minutes for it to run. I'm sitting here in front of a computer all day anyway. Just let me know specifics.

Title: LC prepayments rising

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: sean3.eth on February 23, 2017, 11:00:00 PM

Post by: sean3.eth on February 23, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

The name of the game LC is in is to give as many loans to their good paying borrowers as they can handle for as long as they can handle them. Even more so since they're publicly traded and criticized on every metric like how many loans they're making each quarter. They're likely pounding existing borrowers in good standing with offers to take another loan. POUNDING. I have seen borrowers talk about this on consumer forums.

Title: LC prepayments rising

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

First run this morning failed out of memory. Had to clean up my code a bit.

So with the much looser same person detection, out of 261,189 people (so at least 522378 loans) where the first one is in "Fully Paid" status and the second one:

40,702 - ... is ONE letter grade better or more.

8,469- ... is ONE letter grade better or more and the second loan was started after 350 days and before 550 days of the first loan.

So still out of 1.3M loans not that many point to LC solicited refis soon after 1 year. I can run it with other date ranges or what ever else someone may want. Note that running against all these took a few hours. If we have a few I'll move my DB to the SSD to speed things up.

So with the much looser same person detection, out of 261,189 people (so at least 522378 loans) where the first one is in "Fully Paid" status and the second one:

40,702 - ... is ONE letter grade better or more.

8,469- ... is ONE letter grade better or more and the second loan was started after 350 days and before 550 days of the first loan.

So still out of 1.3M loans not that many point to LC solicited refis soon after 1 year. I can run it with other date ranges or what ever else someone may want. Note that running against all these took a few hours. If we have a few I'll move my DB to the SSD to speed things up.

Title: LC prepayments rising

Post by: Rob L on February 23, 2017, 11:00:00 PM

Post by: Rob L on February 23, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Post by: TravelingPennies on February 23, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: RT45 on February 23, 2017, 11:00:00 PM

Post by: RT45 on February 23, 2017, 11:00:00 PM

This is an area I have spent an extensive amount of time in looking at behavior of repeat / pre-paid borrowers.

I agree with SeanMCA with the 20% figure. Renaud previously stated that 14% of borrowers were repeat borrowers and that was nearly two years ago. He didn't specify how many had simultaneous loans outstanding or were used to pay off another loans - and yes, LendingClub absolutely DOES have this data, unless they are somehow not collecting Social Security Numbers for every borrower - which they are.

We also know that in month 8th, LendingClub begins soliciting refinances of the existing borrowers and is actively promoting it.

Conservatively there are at least 20k borrowers with matching credit profiles, closer to 30k at this point that are either repeat borrowers / pre-pay / or have simultaneous loans outstanding.

Source: https://www.bloomberg.com/news/features/2016-08-18/how-lending-club-s-biggest-fanboy-uncovered-shady-loans

I agree with SeanMCA with the 20% figure. Renaud previously stated that 14% of borrowers were repeat borrowers and that was nearly two years ago. He didn't specify how many had simultaneous loans outstanding or were used to pay off another loans - and yes, LendingClub absolutely DOES have this data, unless they are somehow not collecting Social Security Numbers for every borrower - which they are.

We also know that in month 8th, LendingClub begins soliciting refinances of the existing borrowers and is actively promoting it.

Conservatively there are at least 20k borrowers with matching credit profiles, closer to 30k at this point that are either repeat borrowers / pre-pay / or have simultaneous loans outstanding.

Source: https://www.bloomberg.com/news/features/2016-08-18/how-lending-club-s-biggest-fanboy-uncovered-shady-loans

Title: LC prepayments rising

Post by: Fred93 on February 24, 2017, 11:00:00 PM

Post by: Fred93 on February 24, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on February 27, 2017, 11:00:00 PM

Post by: TravelingPennies on February 27, 2017, 11:00:00 PM

Title: LC prepayments rising

Post by: TravelingPennies on February 28, 2017, 11:00:00 PM

Post by: TravelingPennies on February 28, 2017, 11:00:00 PM

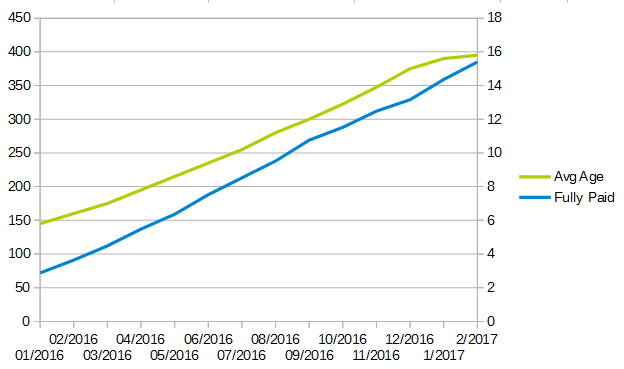

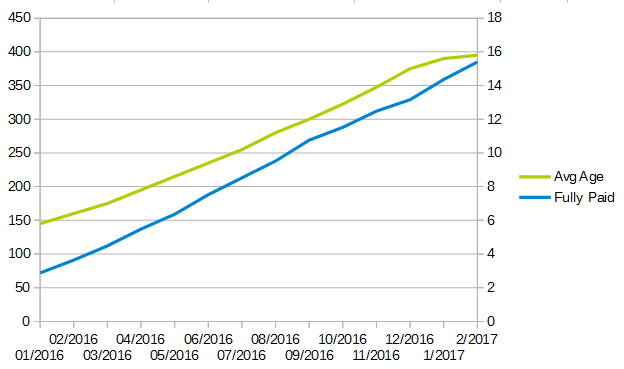

I was just sitting here thinking about a very simple way to see if in my own account if prepayments were increasing or not. I only have the last 14 months of this data on hand and I included the average age of the notes since that could also have an effect. But the of loans going into the fully paid status each month has been really stable for me.

Green = Average age of the portfolio

Blue = Total number of notes in the Fully Paid status

Green = Average age of the portfolio

Blue = Total number of notes in the Fully Paid status

Title: LC prepayments rising

Post by: fliphusker on February 28, 2017, 11:00:00 PM

Post by: fliphusker on February 28, 2017, 11:00:00 PM

I am seeing a spike of prepayments in the past month. The vast majority are coming in regards to my FOLIO notes. As I do not buy notes at a premium it is not a huge deal.

But what I do find strange is that a lot of these notes have a sub 640 FICO with under 20 payments remaining. One that just prepaid had around $6k left with a 560 FICO. Who refinances that? One, in particular, had 600 FICO with IGP the past three months.

This is a bit concerning if there really is a credit market out there that is willing to take on borrowers with such shaky credit.

Kudos to the guy for getting out from underneath his 19% rate. (He was a cop who rents making 48k/year.)

But what I do find strange is that a lot of these notes have a sub 640 FICO with under 20 payments remaining. One that just prepaid had around $6k left with a 560 FICO. Who refinances that? One, in particular, had 600 FICO with IGP the past three months.

This is a bit concerning if there really is a credit market out there that is willing to take on borrowers with such shaky credit.

Kudos to the guy for getting out from underneath his 19% rate. (He was a cop who rents making 48k/year.)

Title: LC prepayments rising

Post by: dr.everett on February 28, 2017, 11:00:00 PM

Post by: dr.everett on February 28, 2017, 11:00:00 PM

Bear in mind that we are into tax season- people may be taking tax returns (assuming they get them) and using them to pay off debt. (If they are wise)

I check my full pays daily and move them to a folder. This morning I had 40 fulls in my IRA, and about 15 in my Taxable account.

I mention the tax refunds because I already received my State refund back- a week after I filed. Waiting on the Fed refund- would be nice if it came this week.

I check my full pays daily and move them to a folder. This morning I had 40 fulls in my IRA, and about 15 in my Taxable account.

I mention the tax refunds because I already received my State refund back- a week after I filed. Waiting on the Fed refund- would be nice if it came this week.